“The report of my death has been grossly exaggerated” quipped Mark Twain, in a now widely-repeated legend (with several variations), responding to a young reporter’s question about the status of his health. Perhaps a similar comment about the retail industry as whole applies today, given the thousands of store closings and dozens of bankruptcies over the last few years which spawned the overexaggerated “Retail Apocalypse” narrative. However, a principal section of retail that has fallen prey to market forces is the “category killer.” Once feared for their ability to specialize in a merchandise segment and dominate a category through discounting and convenience, many category killers (Toys R’Us, Barnes & Noble, Bed Bath and Beyond, to name a few) have fallen or been left behind. In an age of endless aisle, hyper-convenience, and so many upstart brands, the market needs less apprehension and more definitive category leadership from these specialists.

An easy question aimed at gauging a category or vertical’s public sentiment is to ask: will it be more or less successful in 3 years? Followed by a subsequent: why or why not?

Using this framework, we took the most pre-eminent ones – Best Buy, Staples, Barnes & Noble, and Bed Bath & Beyond – and asked: will they be better off in three years? From our point of view, it’s hard to envision a positive scenario where for the totality of the companies the next three years sun shines positively on them. So, why the continuous decline and what can be done about it?

“The calls are coming from inside the house”

The decline of the category killers has centered on a combination of (1) price transparency through digitization, (2) changing consumer definition of “convenience,” and – too often – (3) suspect management decisions. Ironically, the inverse of all three – competitive pricing, localized convenience, and great leadership — is what helped them ascend to prominence in the 2000s. In many ways, this is a classic instance of the old movie idiom “the calls are coming from inside the house” whereby the threats to the category killers come from forces within their four walls.

The proverbial veil on pricing was pierced the moment a customer could search products online. This insight is quite pedestrian, however, it is worth highlighting as the central catalyst bringing about a period of decline. Pricing cannot be an obstacle to customer purchases as Hubert Joly and Best Buy proved early in their turnaround. Pricing parity (along with price matching), coupled with an emphasis on convenience through online ordering for widely distributed product, is now a baseline expectation for customers.

Category killers grew because of their specialization and their ability to carry more products in-store than their competitors. It was a very profitable model and one that drew customers. Today, retailers can no longer rely on having locations as close as possible to the customer to provide convenience, given the ease of online ordering. Amazon and other ecommerce competitors can carry all the products in a typical store (and more).

The combination of price transparency and shifting convenience occurred swiftly and left category killers in a reactionary position – one that many of the leaders failed to react to quick enough. Coupled with the great shifts, the category killers had leadership which failed to identify a compelling strategy. Former Best Buy CEO, Brian Dunn, was named the worst CEO in 2012 by Bloomberg and it was preceded by a cover story in the same publication depicting Best Buy as a “Big Box Zombie” leading up to Halloween 2012.

Barnes & Noble, a bookseller, launched a doomed foray into the tablet market with its Nook to go head-to-head with Amazon’s Kindle. It ended up losing over a $1B on this failed attempt. Suspect leadership decisions made in panic, and without a broader understanding of the historical shift, left category killers flat-footed and faltering. For many, suspect management decisions and an unwillingness to boldly re-think the business model may be the ultimate downfall. Leadership needs to re-think the legacy model that made these retailers so successful to become feared and respected yet again.

The Rehabilitation of the Category Killer

Imagine a world where most of a category’s products are purchased at Target, Amazon, or Wal-Mart. How do customers find new products in-person vs. being led to owned brands or large, established brands? Who will help provide a tailored customer experience? While this may seem like a dystopian retail novel, it is in fact the reality playing out today in the Toy category following the demise of Toys R’Us where the Big Three (Amazon, Target, and Walmart) will take up an estimated 80% share of the toy market in 2018.

Brands and consumers alike should want category killers to thrive more than ever before to keep the large generalists in check, introduce customers to products on the early side of the trend curve, and avoid a highly fragmented market where category purchases occur across many websites.

So, how can category killers rehabilitate themselves? Two ways stick out:

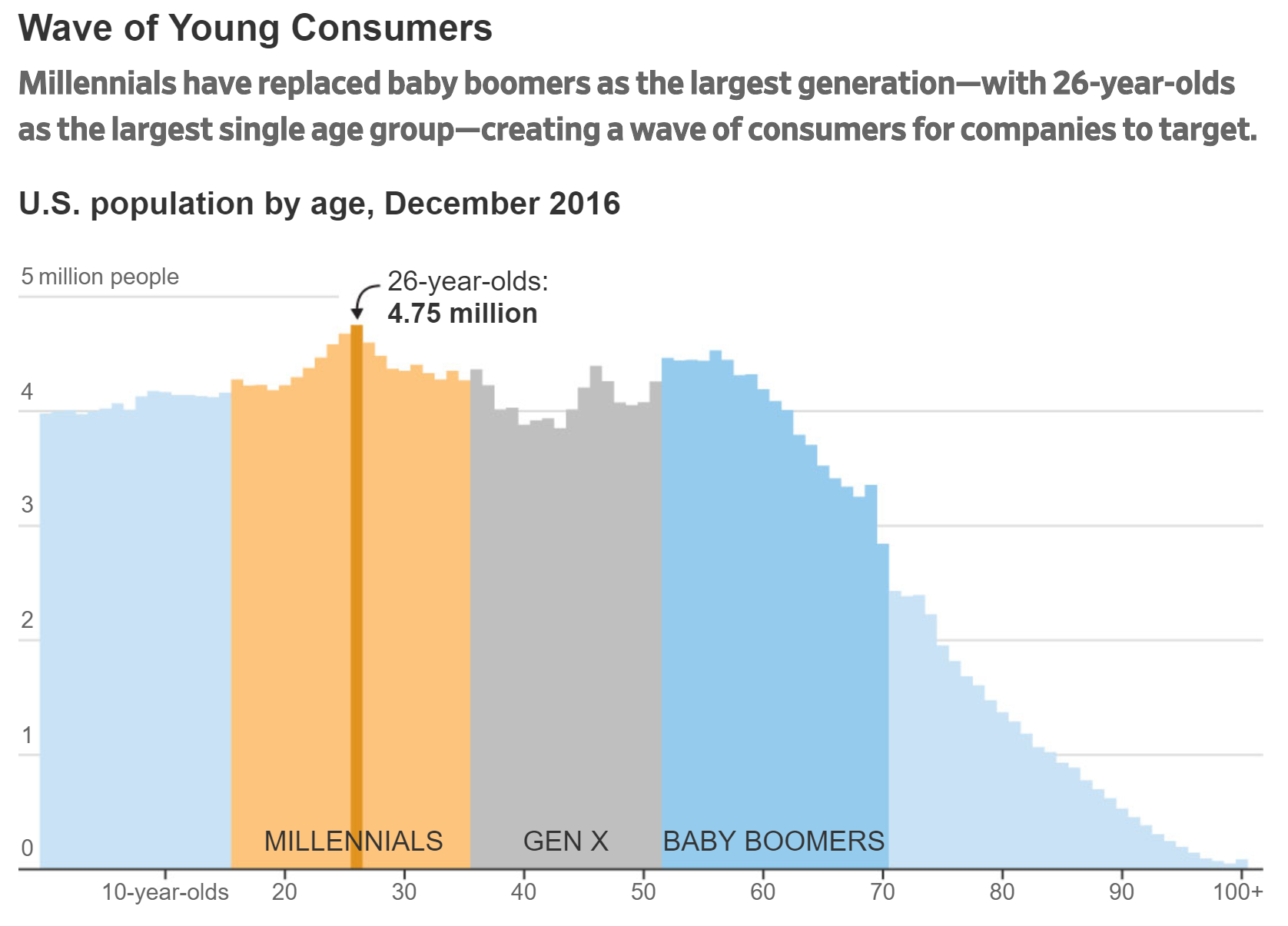

- Curation for discovery to target young consumers

Today, perhaps, the term “category curator” could be more fitting as these companies should seek to leverage their merchandising chops to stand for new trends, brands, and products for customers. Who else would customers trust more than Bed Bath and Beyond to find the newest kitchen gadgets? Or innovative technology at Best Buy? Look no further than Whole Foods which rose to prominence by introducing small, local brands to customers. It worked to build a defensible position in a competitive market such as grocery. Yes, such a strategy entails dedicating floor space to less profitable and slower turning products and creates operational complexity. However, the process of discovering unique brands is important to young consumers and, better yet, difficult to replicate online due to the constraining nature of the search function. Long-tail items, balanced with core product at price parity, create a unique merchandising strategy that give customers a reason to come in-store and engage. Before anything else, the product in-store must be optimized to attract younger customers that seek newness.

- Re-thinking the store experience

More than ever, re-thinking the store experience and redefining a successful store visit needs to be addressed considering how convenience is defined through digitization. No longer is a successful store visit just about basket size but it should be about the customer experience and engagement. Story-telling is a great way to showcase a brand or product and this requires engaged, well-trained staff to execute such a strategy. This exact need for experience and engagement is why Macy’s purchased Story and made their visionary CEO, Rachel Schechtman, their “Brand Experience Officer.”

As Bloomberg writer Virginia Postrel so eloquently summarized: “Now’s the Time for Big-Box Stores to Embrace the 19th Century.” Stores used to be the hub of social activity in communities and they certainly can be again with a shift in thinking on their purpose.

Category killers have the merchandising chops to execute experiences in-store to draw customers seeking to discover new products and brands. There is a way to transition existing floor space to create better experiences and shift fulfillment of common items to a convenience model via online purchasing. Imagine a Barnes & Noble that filled the Toys R’Us void and held regular book readings coupled with tie-ins to live character or visual imagery? How about a Bed Bath and Beyond that showcased some of their most popular kitchen utensils with demos from local or celebrity chefs? These are simple examples that re-think what it means to be a brick-and-mortar store but reflect the belief customer experience drives value over the long-run.

For example, a boutique brand that has placed a story-telling narrative at its core to drive customer affinity is Brunello Cucinelli. Since 1985, the namesake founder has spent untold sums restoring the town of Solomeo in Italy, buying the 14th century castle and surroundings, to provide his employees a comfortable environment which includes the production factory as well as cultural amenities such as a theater complex and a library.

The culture and story reflect the quality of the clothes crafted locally by hand. “Treating people well is at the core of everything, and fostering a beautiful culture is as important as churning out beautiful clothes,” says GQ. Like Cucinelli, category killers should identify their brand’s promise and define their own “beautiful culture” in-store.

In conclusion, given the continued growth and leverage wielded by Amazon and Walmart – along with an increased focus on owned brands – brands and consumers together, should be cheering for the rehabilitation of the remaining category killers. Re-thinking the legacy business model by defining a compelling vision with a dynamic customer experience will help companies reinvigorate their customer base and avoid being mistaken for dead.