We’re back with key takeaways from Day 2 of Shoptalk 2025, once again in partnership with the great folks at Catalant.

If you missed our Day 1 recap, it can be found here.

Here’s what stood out from Day 2 (with a few anecdotes from Day 1 sprinkled in).

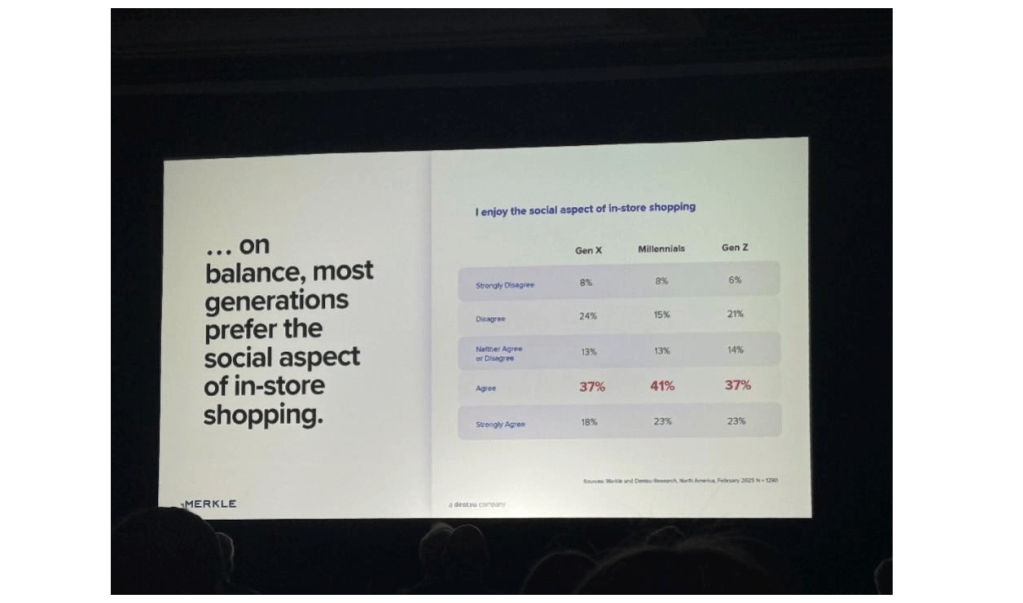

1. Back to the future for young consumers: the physical retail store.

With all the buzz around AI and digital media, it’s easy to overlook the fact that the oldest retail channel—brick-and-mortar stores—still accounts for 80% of all retail sales.

Factor in that many retailers now use stores as fulfillment hubs for digital orders, and it’s clearer than ever: physical stores remain essential.

And here’s something that stood out in a few sessions—younger consumers are leading the charge back to stores.

As retailers double down on digital and tech-enabled initiatives, the fundamentals still matter: clean stores, stocked shelves, and great service. These basics remain as powerful as ever—especially when attracting younger shoppers.

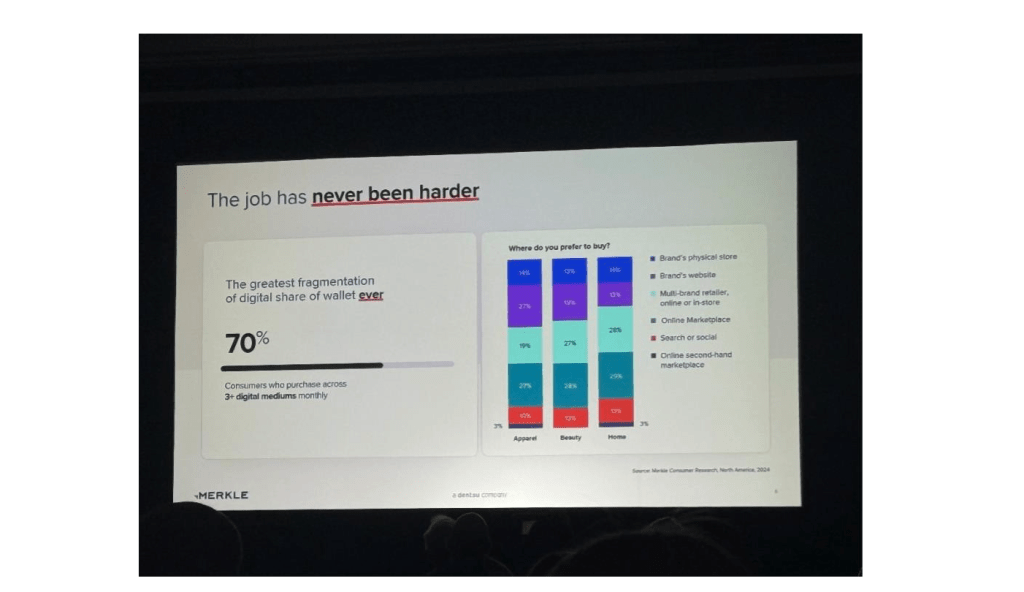

2. Brand building and marketing: more complex than ever, but still critical

Retail, like many industries, is feeling the impact of fragmented and decentralized media. Gone are the days when a single ad buy on major TV networks could reach most of your customers. Today, marketing strategies must span numerous channels to stay top of mind.

Kevin O’Leary, aka “Mr. Wonderful” from Shark Tank, spoke about brand building for smaller businesses, emphasizing the importance of understanding CAC (Customer Acquisition Cost) and ROAS (Return on Ad Spend). As expected, he didn’t hold back.

The challenge? Measuring CAC and ROAS accurately is harder than ever. In fact, ROAS itself is losing favor with many marketers, as pointed out by Holden Bale from Merkle. The complexity of modern media strategies means brands must be even more precise in targeting customers and measuring effectiveness.

That said, this fragmentation creates opportunities. Brands that can reach customers effectively stand to gain market share, especially as many retailers take a cautious approach to growth.

3. Missing from Shoptalk: the supply chain conversation

One of the most notable absences from Shoptalk this year? Supply chain discussions.

Sure, supply chains don’t have the same flash as AI or media, but in conversations with executives, it’s clear: it’s a top priority for 2025.

Look no further than recent moves by major players:

- Target investing in its grocery supply chain · Sam’s Club and Walmart consolidating their supply chains · BJ’s Wholesale focusing on Fresh to drive growth

- Sam’s Club and Walmart and Walmart consolidating their supply chains

- BJ’s Wholesale focusing on Fresh to drive growth

Add in the uncertainty of tariffs, and supply chain strategy is front and center for many retail leaders. Any conversation about “playing to win” in the coming years starts here.

Add in the uncertainty of tariffs, and supply chain strategy is front and center for many retail leaders. Any conversation about “playing to win” in the coming years starts here.