September marks the start of several annual milestones for many: Fall, school, football and, for those in retail, Groceryshop in Las Vegas. This year is no different with the conference well underway and a full lineup of speakers to come.

As in years past, we have you covered with daily recaps and a wrap-up at the end of the conference if you want the Cliff’s Notes version.

So, without further ado, our three observations from the first day:

1. Retailers want to sell stuff (services) to other retailers

At Shoptalk this past March, you could not miss the presence of providers, such as DoorDash, Instacart and UberEats, that want to partner with retailers. Groceryshop has expanded on this theme with retailers touting their own services. Sponsors this year include Walmart Connect, Shipt (Target) and even Amazon with Just Walk Out technology.

Source: The Navio Group

Expect the competition to be fierce as larger retailers vie to provide “retail as a service” solutions that smaller players cannot afford given the technology’s significant capital outlays and maintenance costs to enable order fulfillment, delivery, automation and retail media networks. For the larger retailers that are making those investments, this is a natural way to offset the large price tags while adding new, highly profitable revenue streams.

2. Grocery is about scale, and the largest players can invest in technology and then gain share – a virtuous cycle

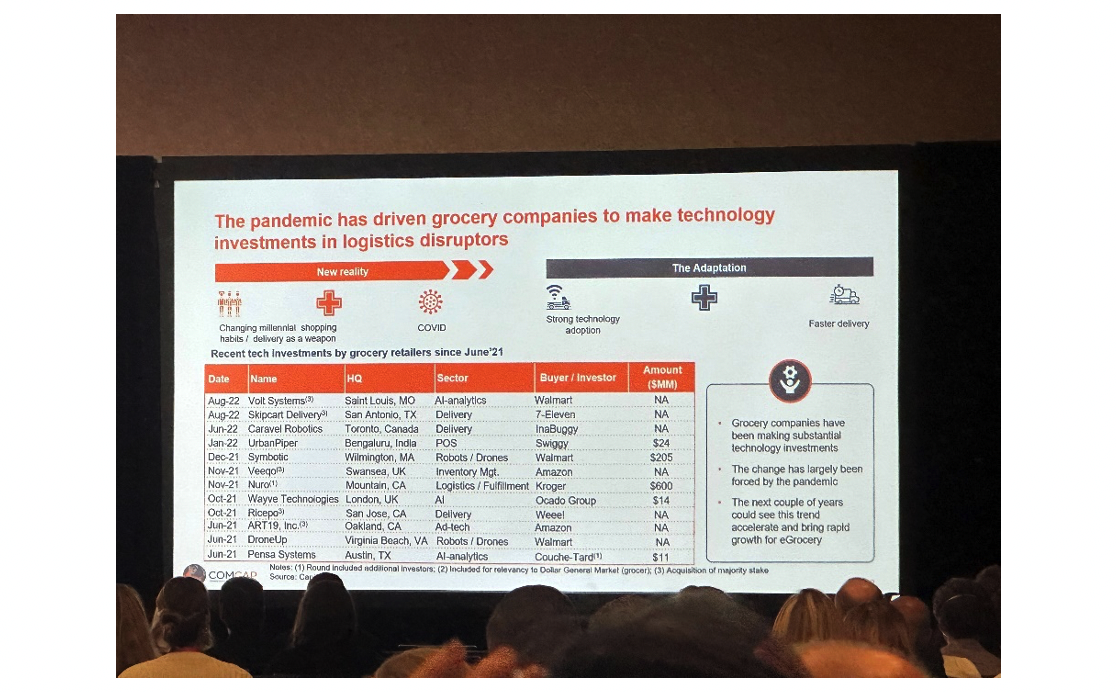

Scott Moses from Solomon Partners gave an overview of the grocery industry and highlighted how mergers and acquisitions (M&A) have been a key part of the grocery industry and will continue to be given the thin margins in grocery and, thus, the need for scale to grow profits.

You might say that a banker advocating for M&A is convenient; but as the saying goes, the numbers – be they private equity investments or grocer margins – do not lie. As Moses highlighted, the largest players in grocery have only seen market share and profit accrue in their favor.

Further consolidation will take place because of the need to a) drive down costs and b) spread out necessary technology investments across a higher sales base and stores. Offering better digital service options for customers is now table stakes and requires the investments in technology that larger retailers, such as Walmart, Kroger and others, are making to better serve customers.

Source: Aron Bohlig, ComCap

3. Grocery is leading the technology revolution across retail

For many years, grocery was an old school business with legacy practices and systems. Then the pandemic came along and upended everything.

As one attendee and former client remarked last year: grocery was a sleepy business until the pandemic came and accelerated a host of ideas that many in the industry had thought would happen over five or maybe 10 years.

The reason technology has proven important in grocery is precisely because of the thin margins, complex SKU base and the wealth of data that comes from frequent customer purchases. Increasingly, the convenience of digital ordering and delivery has become a key part of a customer’s omnichannel grocery experience.

In this vein, Omnitalk’s Chris Walton hosted an informative, rapid-fire roundtable discussion with some executives to assess the practicality of frequently mentioned consumer technologies.

The verdict?

Electronic shelf labels, robotics and RFID were the technologies most favorably viewed by the panelists. Livestream shopping, text-based commerce and smart carts were a tossup, and livestream shopping and the Metaverse received more tepid responses from the group which did not rate them as much of a priority.